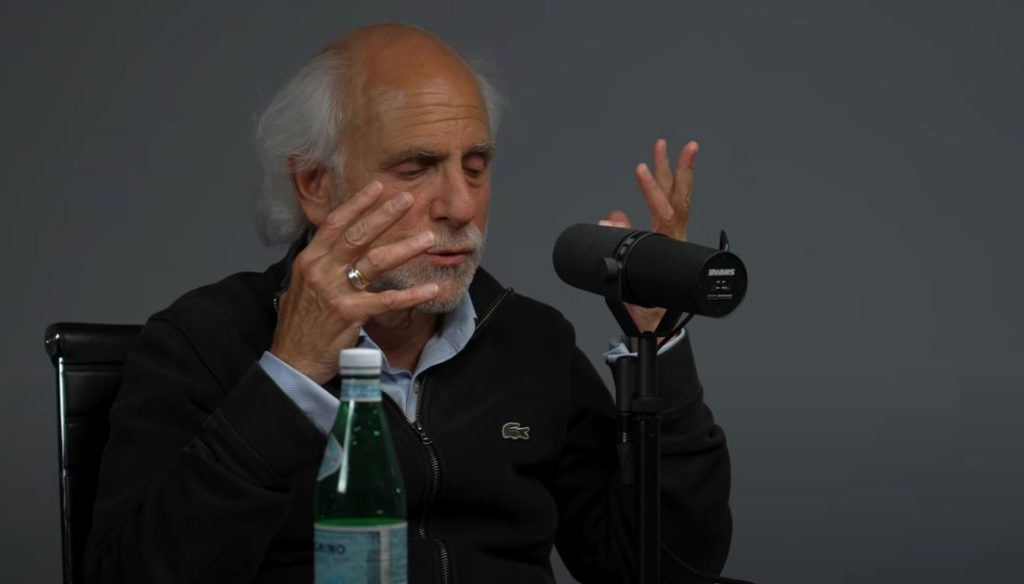

Peter Tuchman’s projected $20 million net worth in 2025 is evidence of his tenacity, prominence, and unique capacity to turn market turmoil into a personal legacy. Tuchman has transformed his career on the floor of the New York Stock Exchange into something that feels remarkably effective at capturing both money and meaning. He is known as the “Einstein of Wall Street” because of his wild hair and animated expressions. In an industry where many careers disappear as quickly as trading cycles, his story is about creating a profile that is remarkably durable rather than about becoming the wealthiest man in finance.

Tuchman has managed events that rocked markets to their foundations while trading billions of dollars’ worth of stocks over the course of four decades. He was a remarkably similar presence on the floor from Black Monday in 1987 through the dot-com bubble, the 2008 financial crisis, and the GameStop-led meme-stock frenzy—animated, responsive, and remarkably clear in his understanding of volatility. His images would show up whenever headlines shouted panic or euphoria, making him the face of uncertainty itself. Few traders have ever attained the additional levels of recognition brought about by that role, which was widely publicized in the media.

| Category | Information |

|---|---|

| Full Name | Peter Michael Tuchman |

| Date of Birth | December 23, 1957 |

| Age (2025) | 67 |

| Birthplace | New York City, USA |

| Nationality | American |

| Profession | Stock Trader, Broker, Media Personality |

| Nickname | “Einstein of Wall Street” |

| Education | University of Massachusetts (Economics, Agriculture) |

| Employer | New York Stock Exchange (NYSE) |

| Estimated Net Worth | $20 million (2025) |

| Main Income Sources | Trading commissions, brokerage, media features, public speaking |

| Spouse | Lise Zumwalt Tuchman (deceased 2023) |

| Children | Benjamin Tuchman, Lucy Tuchman |

| Recognition | Most photographed trader on the NYSE floor |

When weighed against his symbolic influence, his $20 million financial position is especially advantageous. Tuchman’s wealth may seem small in comparison to hedge fund tycoons who own billions. His worth, however, comes from more than just money; it also comes from knowledge exchanged, trust established, and a reputation that has significantly raised awareness of floor trading in general. His career serves as an example of how charisma and reputation can be extremely effective in opening doors outside of trading desks.

Some have inflated figures as high as $300 million in speculation that he may be sitting on hidden millions, according to discussions on Reddit and finance forums. Although amusing, these assertions show how Tuchman has come to symbolize speculation in general, with his wealth being contested nearly as fiercely as the stocks he owns. The fascination is comparable to the craze surrounding Keith Gill, popularly known as Roaring Kitty, whose ascent through memes turned Gamestop into a financial and cultural phenomenon. Tuchman, on the other hand, represents the human aspect of trading that endures, embodying both the chaos and the continuity.

His financial journey is made even more poignant by his background. Peter was raised with the fortitude of parents who had rebuilt their lives after being devastated by the Holocaust. His father, Marcel, demonstrated a discipline that was incredibly dependable and a devotion that was exceptionally durable by practicing medicine into his nineties. Peter’s choice to stay on the floor long after many of his peers retired or switched to electronic systems is a reflection of this family’s legacy of perseverance. For him, the floor is a theater of resiliency where every day presents a fresh opportunity to persevere and adjust, rather than just a place to earn money.

Cultural storytelling also touches on Tuchman’s personal life. While his own expressive presence energized the drama of markets, his late wife, filmmaker Lise Zumwalt, brought stories to life on screen. Their combined careers combined art and finance, demonstrating how communication and visibility can greatly close the gap between complex systems and regular audiences. He is now more than just a market symbol because of his family life, especially raising his kids after her death in 2023, which has given his public appearances more emotional weight.

Tuchman has publicly questioned electronic trading, claiming that it hasn’t made markets noticeably faster or more equitable, in contrast to many traders who have embraced digital systems. He believed that floor trading’s interpersonal exchanges and hand signals were extraordinarily flexible instruments that guaranteed transparency that algorithms frequently obfuscate. His viewpoint sets him apart from today’s fintech entrepreneurs, but it also shows how tradition can be especially creative when it comes to human trust.

His career has been remarkably shaped by the media’s fascination with his face. His words—anguish, relief, and desperation—became the abbreviation for his explanations of markets to the public during tumultuous sessions. Tuchman’s humanity served as a narrative anchor in a time when faceless platforms and algorithms predominated. Tuchman’s presence has become a financial indicator and a cultural abbreviation for volatility itself, much like Elon Musk’s tweets have the power to influence billions of people.

His $20 million net worth may appear surprisingly modest when compared to billionaires, but it is a very trustworthy indicator of perseverance. He shows that legacy and influence are more important indicators of wealth in the financial industry than hedge fund size. His career has given journalists a voice to tell the story of markets, reassured anxious investors, and inspired young traders. He serves as a reminder that, like politics or the arts, finance depends on people who captivate the public as much as on numbers.