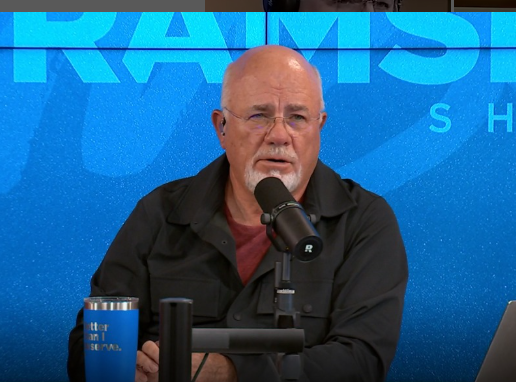

Few personal finance professionals have amassed an empire as well-known and incredibly successful in recent decades as Dave Ramsey. His $200 million net worth in 2025 is based on the practical disciplines of asset management, hard-earned reinvention, and a remarkably similar story to many of the people he has helped, even though his teachings frequently evoke scripture as much as spreadsheets. Radio stations, book shelves, and church pews still reverberate with his personal tale of success, failure, and rebirth.

Ramsey accumulated a real estate holding of more than $4 million by the time he was 26. He became a millionaire early in life thanks to these investments, which were supported by aggressive borrowing and quick property flips. Yet, excessive leverage invites risk, as financial history has repeatedly cautioned. The collapse occurred in 1988. At the age of 28, he filed for bankruptcy after two banks called in his loans. But his second act was born out of that public failure.

Dave Ramsey Net Worth – Bio and Financial Snapshot

| Detail Category | Information |

|---|---|

| Full Name | Dave Lawrence Ramsey III |

| Date of Birth | September 3, 1960 |

| Age | 64 years (as of 2025) |

| Nationality | American |

| Occupation | Author, Financial Advisor, Radio Host |

| Estimated Net Worth | $200 Million (2025 Estimate) |

| Real Estate Portfolio | Valued at $150 Million (approx.) |

| Major Income Sources | Real Estate, Books, Courses, Radio |

| Famous Work | “The Total Money Makeover” |

| Media Empire | The Ramsey Show (over 500 stations) |

| Marital Status | Married to Sharon Ramsey |

| Education | University of Tennessee, Knoxville |

| Known For | Debt-Free Living Advocacy |

| Official |

After his financial collapse, Ramsey became deeply involved in studying the Bible. He started advising couples on budgeting and debt repayment after being especially moved by verses pertaining to stewardship, debt, and generosity. These unofficial meetings ultimately came together to form Ramsey Solutions, a financial education organization whose reach has significantly expanded over time via multi-channel platforms.

From humble beginnings, his radio show, The Ramsey Show, has grown to reach over 500 stations and over 18 million listeners each week. The program is a highly effective pillar of Ramsey’s larger financial base because it generates a sizable amount of advertising revenue—some analysts estimate it brings in over $10 million annually. His “Baby Steps” approach, which provides a route to financial tranquility based on gradual debt reduction and savings, draws listeners in.

Ramsey has written several best-selling books in addition to his success on television. Financial Peace, Smart Money Smart Kids, and The Total Money Makeover are still in high demand and have been on several bestseller lists. These publications offer steady streams of royalties in addition to course and live event sales. Many participants view these as spiritual awakenings where grit and guidance meet, rather than merely financial seminars.

Ramsey’s portfolio is still heavily weighted toward real estate. He acknowledges that he owns a number of commercial properties in addition to 15 to 20 debt-free homes. Ramsey has eliminated recurring liabilities and established a cash-flow-heavy investment strategy that is incredibly dependable and remarkably sustainable by refusing to use mortgages, a philosophy that stems from his bankruptcy trauma. In a time when even well-known investors like Grant Cardone advocate using leverage to increase wealth, Ramsey’s debt-free approach is especially novel and distinguishes him both strategically and ideologically.

His mutual fund investing strategy is similar to his real estate strategy. Diversification across four fund categories—growth, growth and income, aggressive growth, and international—is something he consistently promotes. Although he doesn’t name the mutual funds he owns, his approach promotes professional fund management and extended holding times. He strongly opposes following speculative trends like cryptocurrency or picking individual stocks, which is frequently in stark contrast to contemporary influencers like Cathie Wood and Kevin O’Leary.

Ramsey’s empire is noticeably devoid of debt. One basic idea underpins his business, personal life, and investment approach: live within your means and refrain from taking out loans. His dedication is both antiquated and remarkably foresighted in a financial environment that is increasingly dominated by leveraged lifestyles and buy-now-pay-later plans. Through the use of biblical conviction and emotional clarity, Ramsey has developed a philosophy that appeals to generations of people who have grown weary of excessive consumption.

He has his detractors. Some have questioned whether his advice is practical in urban housing markets where owning a home without a mortgage seems like a pipe dream or scalable for lower-income families. Some contend that his opinions on credit cards and student loans are unduly inflexible. Nevertheless, he has established trust by being reliable, and trust generates income, clout, and longevity.

A number of public figures have been influenced by Ramsey’s teachings. Reality stars like Sadie Robertson and NFL players like Derrick Henry have publicly supported his debt-free challenge. His “Financial Peace University” classes are taught in churches all over the country, and many of them believe that his teachings are spiritually nourishing as well as financially enlightening. In that situation, his voice goes beyond simple counsel and takes on a leadership role.

Today, Ramsey Solutions, his company, has more than 1,000 employees. Internally referred to as “Ramsey Plaza,” its Nashville headquarters serves as a hub for hybrid media and education. Employees are prohibited from having personal debt; this is ingrained in the company culture. The brand values are especially evident and purpose-driven because the company bases its performance bonuses not only on profit margins but also on mission alignment.

Ramsey’s financial empire is unique in that it is based on transformation rather than merely making money off of information. Despite their extreme versatility, his financial tools are based on a philosophy that prioritizes integrity over quick wins, discipline over flash, and patience over speed. Despite being traditional, these ideas have significantly improved the lives of innumerable households, particularly in difficult economic times.

Millions of people experienced credit card debt, foreclosures, and layoffs during the pandemic. Ramsey’s advice to live below one’s income, avoid auto loans, and accumulate an emergency fund suddenly sounded more prophetic than preachy. His fundamental tenet—that people who shunned debt fared better when the economy became unstable—was confirmed by the crisis.